Marketplace Use Case

Applicable to Marketplace Businesses

Merchant Account Setup

| Entity | Account type in Platform Model | Merchant of Record (MoR)* | Country of the business entity | Business example |

|---|---|---|---|---|

| You | Platform Merchant (Marketplace Business) | Yes | Japan only | Uber Eats |

| Your Seller | Payout Merchant | No | Japan only | Deliverers and restaurant owners on Uber Eats |

*MoR stands for “Merchant of Record,” the entity that directly accepts payments from customers.

In this model, the Platform Merchant (Marketplace Business) account functions as a parent account, while Payout Merchant accounts operate as child accounts. The Platform Merchant can manage all the capabilities of the Payout Merchant accounts.

Onboarding Overview

- Contact our Account Manager or submit an inquiry via inquiry form to request Platform Merchant (Marketplace Business) credentials. Once received, log into the KOMOJU dashboard and access the "Test" environment.

- Integrate KOMOJU APIs and create test Payout Merchant accounts under your account. Then, run mock payments between your account and Payout Merchant account to ensure functionality.

- When ready for live operations, start the Live Application for your Platform Merchant (Marketplace Business) account through KOMOJU's dashboard.

- After your live application is approved, create real Payout Merchant accounts through the APIs in the "Live" environment.

- Once the Payout Merchant account gets approved, you can start processing real payments between you and your seller.

Learn more details:

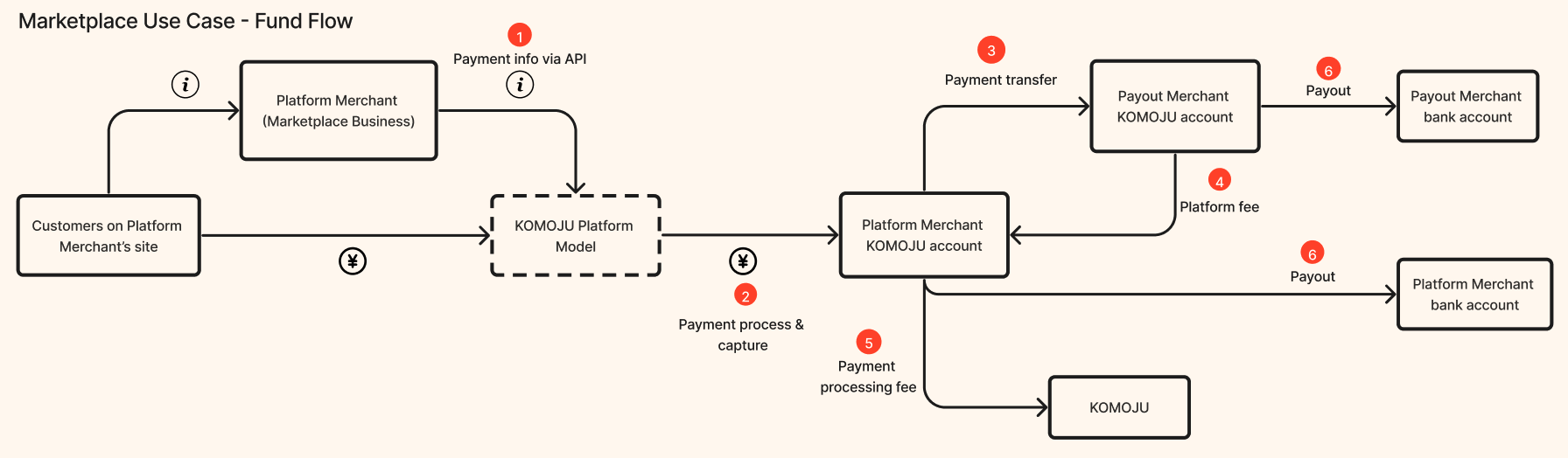

End-to-End fund flow

- A customer completes checkout on the Platform Merchant’s website. At the same time, the Platform Merchant should call KOMOJU's Payment API to submit essential payment details, specify how payments are split among Payout Merchants, and indicate the Platform Fee amount.

- KOMOJU processes the payment under the Platform Merchant's account as the Merchant of Record (MoR), following the Platform Merchant's API request.

- Once the payment is captured, funds are transferred to the Payout Merchant, as these constitute the Payout Merchant’s revenue. The Platform Fee serves as the commission charged by the Platform Merchant to the Payout Merchant.

- KOMOJU automatically deducts a Payment Processing Fee from the Platform Merchant, calculated based on the fee rate in the Platform Merchant's Owned Payment Methods.

- KOMOJU deposits the accumulated Platform Fees to the Platform Merchant's bank account and the proceeds to each Payout Merchant's bank account, according to the specified payout schedule. (Note: Payout cycles for Platform Merchant and Payout Merchants operate independently and may vary in frequency. Learn more here.)

Payment processing

For the Marketplace Use Case, the Platform Processing Model is used for payment handling and supports splitting payments between a single or multiple Payout Merchants.

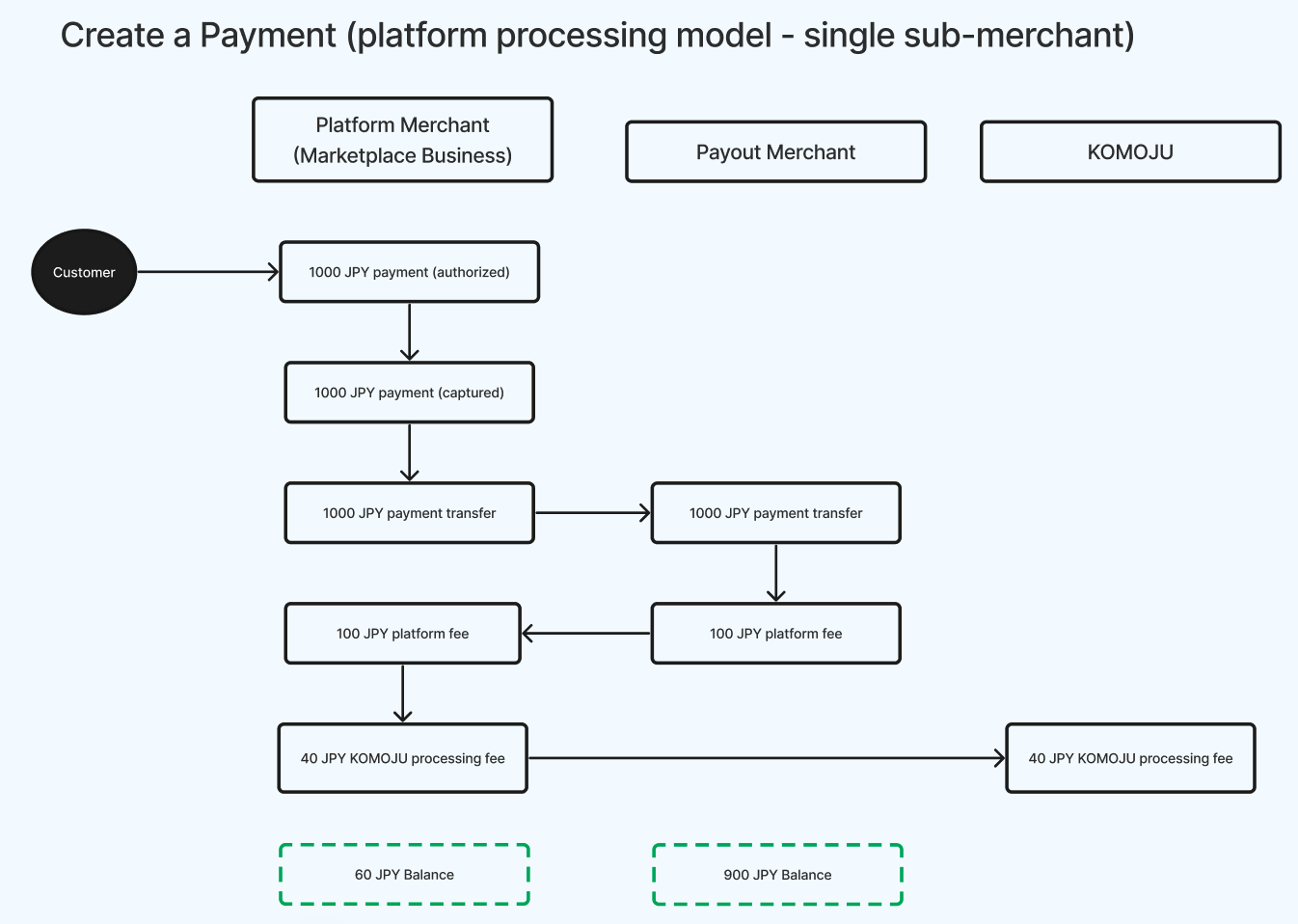

(1) Single Payout Merchant

An example use case is a transaction between Airbnb and an Airbnb host, where a single participant fulfills the order. Below is an example of payment processing between a Platform Merchant and one Payout Merchant:

- After payment capture, funds are transferred to the Payout Merchant.

- The Platform Merchant specifies the Platform Fee amount to be charged to the Payout Merchant.

- The Platform Merchant pays KOMOJU's Payment Processing Fee, based on the fee rate in its Owned Payment Methods.

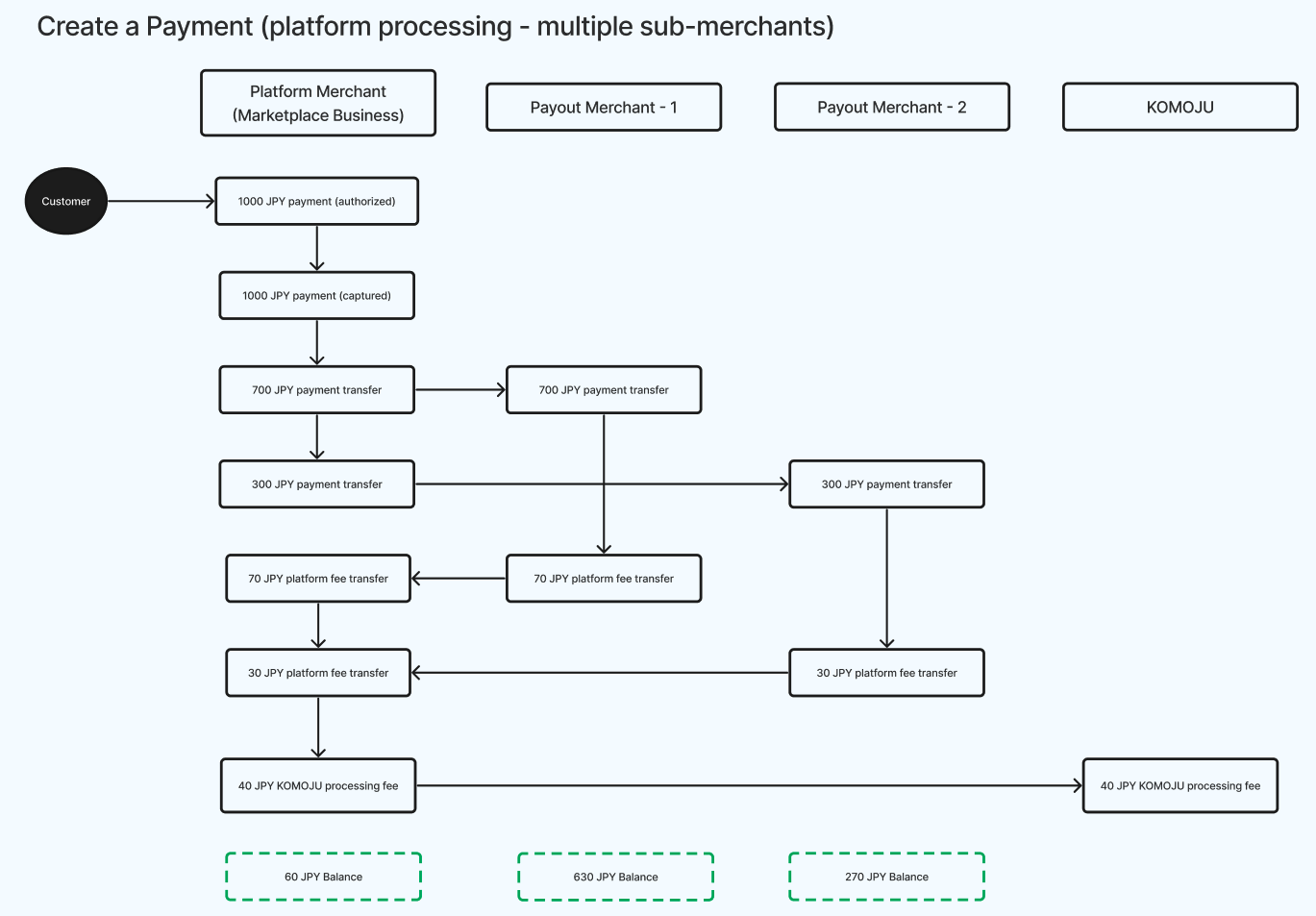

(2) Multiple Payout Merchants

An example use case is Uber Eats, where multiple participants, such as a restaurant and a delivery partner, fulfill the order. Below is an example of payment processing involving multiple Payout Merchants:

- The Platform Merchant specifies the payment amount allocated to each Payout Merchant, ensuring the total matches the payment amount.

- The Platform Merchant specifies the Platform Fee amount charged to each Payout Merchant.

- The Platform Merchant pays KOMOJU's Payment Processing Fee, based on the fee rate in its Owned Payment Methods.

To learn more about payment-related actions (e.g., Capture, Refund, Chargeback) within the Platform Processing Model, please refer to Platform Processing Model (for Marketplace Use Case).

Payment Method Setup and Processing Fee Rate Setup

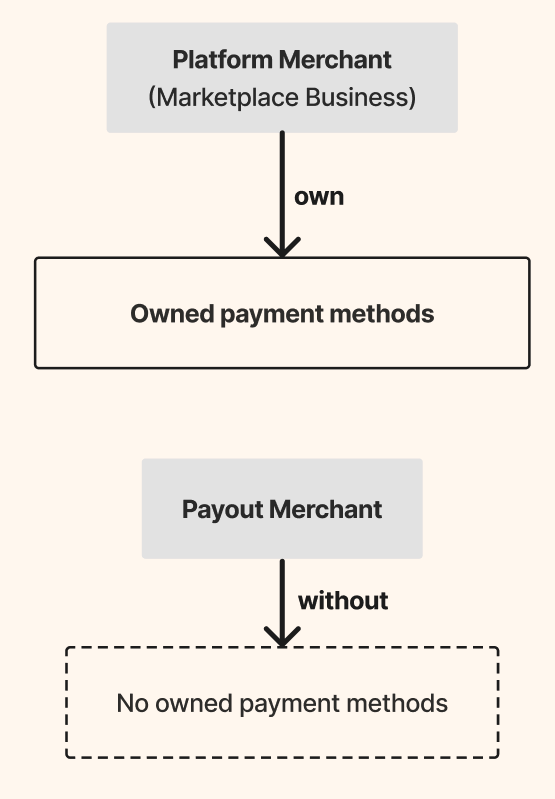

(1) Owned Payment Methods

- Platform Merchant (Marketplace Business) must configure “Owned Payment Methods,” which contains:

- The payment methods available for customer checkout.

- The processing fee rate that KOMOJU will charge the Platform Merchant on each captured payment.

- KOMOJU offers popular Japanese payment methods for Owned Payment Methods, including:

- Credit Cards (Japan) (Visa, MasterCard, JCB, AMEX, and Diners)

- Bank Transfer

- Pay-Easy

- PayPay

- Merpay

- Konbini Payment(s)

- In contrast, Payout Merchants do not configure Owned Payment Methods, as they do not process payments directly.

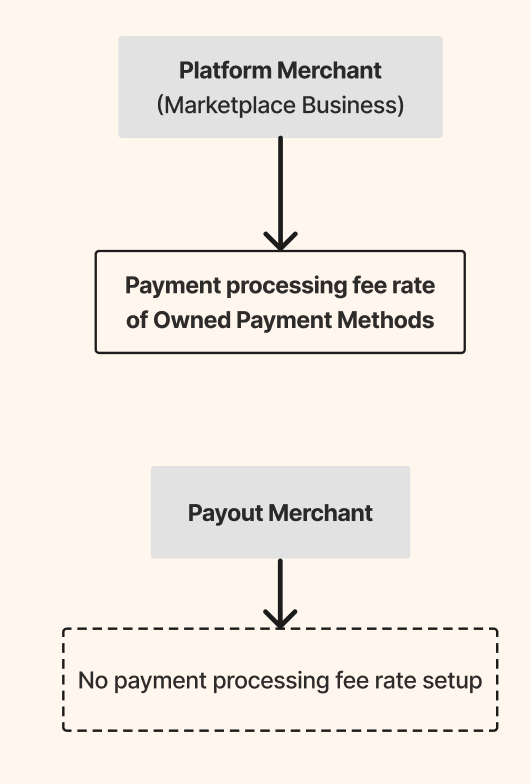

(2) Payment Processing Fee

- The Platform Merchant is responsible for paying the Payment Processing Fee to KOMOJU.

- Calculation: Payment Processing Fee = Payment Amount Payment Processing Fee Rate*

- The processing fee rate is based on the Platform Merchant’s Owned Payment Methods.

- The concept of Payment Processing Fee Rate setup

Sub-Merchant Management Fee Setup

(1) Concept

- The Platform Merchant pays a Sub-Merchant Management Fee to KOMOJU. This fee is charged at the beginning of each month, covering the prior month’s activity.

- The fee rate is fixed, but the total fee depends on the number of “active” Payout Merchants in the previous month.

- Definition of “active”: A Payout Merchant is considered active if it participated in one or more captured payments within the month.

(2) Fee calculation

- Sub-merchant Management Fee = Fixed fee rate Number of active Payout Merchants in the previous month*

- Example:

- Assume the Platform Merchant has three Payout Merchants (A, B, and C) and the fixed fee rate is ¥1,000.

- Last month, only Payout Merchants A and B participated in a captured payment.

- At the beginning of this month, the Platform Merchant will be charged ¥2,000 for the Sub-Merchant Management Fee (¥1,000 * 2 = ¥2,000).

Updated 9 months ago